Democratic Presidential Nominee Joe Biden has been no stranger making his position clear that he should become president. He will raise taxes on high-income earners and give tax breaks to the middle and lower income earners, as well as hold corporate taxpayers to high expectations regarding paying their fair share than his predecessor.

Biden’s campaign has released a document discussing the problems with President Donald Trump’s economic coronavirus response as well as outlining the democratic nominee’s major issues with Trump’s Tax Cuts and Jobs Act of 2017 (TCJA), citing that most of the benefits went to the ‘top 1%’ while quietly building in tax increases for the middle class.

The document released by the campaign is not a comprehensive tax plan in the sense that it does not lay out each tax proposal. Rather it discusses some of his ideas around tax policy, and points out what he disagrees with in the current tax system, but it offers a good starting point for thinking about what a Biden tax reform bill might look like.

Biden proposes a number of tax increases aimed at high-earning taxpayers, and says that “he won’t ask a single person making under $400,000 per year to pay a penny more in taxes”. This promise is upheld in the tax policy he proposes, though economic literature is clear that legal tax incidence is not the same as who actually pays the tax.

Erica York, an economist on the Tax Foundation’s policy federal tax team, says that shareholders and workers bear most of the burden of the tax in the long run either through reduced compensation or returns on investment. Labor, as the least mobile factor, will bear the most of the burden, further contributing to wage stagnation.

The Committee for a Responsible Federal Budget estimates that a .2% to .4% increase in prices may be observed as companies pass on the tax expense to their consumers, which would hit low income earners the hardest due to the percentage of their income spent rather than saved. Any increases in the price of essentials acts as a wage reduction for families who are already struggling to make ends meet.

Biden has proposed raising the corporate tax rate to 28% from the current rate of 21%, as set by the TCJA. This would put the United States’ corporate tax rate above the OECD average, but Biden understands that and has signaled he is against the ‘race to the bottom’ regarding corporate tax rates, where countries lower their rates in an effort to become more ‘competitive’ and end up giving away millions of dollars of tax revenue for minimal gains in growth.

Under TCJA, companies were taxed on foreign held assets at reduced rates under the program global intangible low taxed income (GILTI). Cash held abroad was taxed at 15.5% while non-cash assets were taxed at 8%, with the tax liabilities able to be spread out across 8 years. The GILTI provision of TCJA subjects taxpayers (corporate and individual) to tax on ‘supernormal’ returns of foreign assets, to combat companies sending intellectual property abroad to take advantage of tax havens. The provision was an outbound anti-base erosion program aimed at retaining taxing rights for companies seeking to reduce their US tax liability. Biden wants to expand GILTI to encompass all foreign earnings, not just those of ‘supernormal’ returns (more than 10% returns on qualified invested foreign assets) on assets, meaning that the US would tax a companies worldwide income.

Biden’s campaign has also proposed additional taxes on corporations that “ship jobs overseas” and then “sell products back to America”. This targets large domestic companies who, rather than follow US labor and wage laws, prefer to set up manufacturing facilities in low-wage countries, taking advantage of the workers and lax-labor laws. These moves have only one goal for the companies, which is to maximize profits.

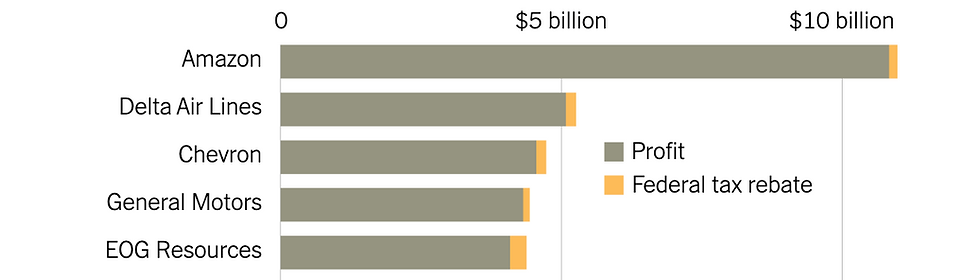

The plan calls for implementing a ‘book income’ tax on corporations. Corporations have two types of net income: book income and tax income. Book income is what is reported to shareholders and the SEC in the form of 10-K’s and P&L statements. Tax income is more complicated, and includes book income, but applies tax credits and deductions to arrive at the income that a company is taxed on. These can vary widely as seen with Amazon who, despite posting a profit of $10 billion in 2018, only paid $1.197 billion, for an effective tax rate of about 12%. Under Biden’s 15% minimum tax on book income, Amazon would be on the hook for at least $1.5 billion. The difference between the two is a $303 million dollar increase in the tax bill of Amazon, if not more.

As a part of the TCJA’s key provisions for high-earning individual taxpayers was the reduction of the top tax rate from 39.6% to 37%. Biden would like to reinstate the higher top marginal tax rate. This comes under his plan to make the high-earning taxpayers pay their ‘fair share’ while giving middle and lower income earning taxpayers a much needed break due to ‘stagnating wages’ and ‘ever-increasing cost-of-living’ expenses.

A long held tenet of the U.S. tax system has been promoting long term investment horizons, and trying to keep the tax system from becoming an impediment to economic growth. According to economic literature and empirical analysis, capital gains are extremely tax sensitive, meaning that changes in their tax treatment mean large changes in the actual realization of those gains. Taxing long term capital gains at a reduced rate ensures that if investors hold on to an asset for long enough, they can realize their gains at a reduced tax rate. Biden wants to eliminate the reduced rate of capital gains for taxpayers earning over $1 million dollars, and instead taxing the investment income at the tax rate their bracket assigns them, 39.6% rather than 20%. This treatment of investment income would also apply to dividends, which have long been divided into two categories, one receiving preferential treatment and one not in recognition that some dividend income has already been taxed at the corporate level.

Currently the social security payroll tax is applied to wages up to $137,700, but Biden wants to apply it to wages above $400,000 to act as an additional tax on high-income earners. Slowly, the lower limit of the ‘donut hole’ would creep up with inflation, and eventually all wages would be subject to social security tax. The extra tax revenues would be used to add to the trust funds, securing the benefits for the future generations, long past what the current state of the trust funds could.

The plan suggests using the increased tax collections to fund many tax credits for middle and lower income earners, such as an expansion of the child tax credit, health insurance affordability credits, childcare tax credits, and a second round of the first time homeowner tax credit. These credits would work to reduce the tax liability of the middle class, and, according to Biden, provide much needed support to those who need it most.

Biden has suggested other tax changes such as eliminating the step-up in basis for heirs of assets from deceased owners, which allows them to not pay capital gains tax on appreciation earned while the owner was still living, and only required to pay tax on appreciation between the date of death and date of sale.

Paul Krugman, in a New York Times article discusses the possible growth effects that the increasing tax rates might have on the US economy. He says, “Biden’s plan would roll back that corporate tax cut, replacing it with spending programs likely to yield much more bang for the buck.” He goes on to say that Biden would then use the increased revenue to fund “ ... outlays aimed at strengthening the economy in the long run, as well as boosting it over the next few years,” such as education and infrastructure investments.

According to the Tax Foundation, the changes would raise $3.05 trillion in 10 years, and reduce GDP by 1.47% in the long run. Contrasting that estimate, the Committee for a Responsible Federal Budget report that estimates revenues of $3.35-3.67 trillion with a 1.3-1.4% increase in GDP in the long run.

The tax changes would increase government revenues that could be used to sure up the social security trust funds and reduce deficit spending, but stunting economic growth could have dire consequences for the US economy.

It’s fair to say that the tax increases will have a sizable impact on the economy, but just what that impact will be has not been conclusively decided. Economic conditions and recovery from the Coronavirus triggered recession may change the specifics for but the fundamentals remain the same for the Biden tax plan; increase taxes on high-earners and cut taxes for the middle and lower classes.

Comments